UNDERSTANDING CAPITAL ALLOWANCES

Many Solicitors are facing litigation for the consequential loss of tax savings due to inaccurate or poorly advised entries. But we can help. Our fully integrated online solution takes only minutes to complete and provides total indemnification for your company.

We provide a completed s198 or s199 form after assessing the capital allowances position of your Client’s property. Our system is fully traceable with real-time information available via your custom online dashboard.

The Finance Bill 2012 radically changed the rules for claiming capital allowances on commercial property. The transitional period that ended in April 2014, means that you now must be complying with the legislation.

There are new obligations on both seller and buyer to agree the capital allowances position or they risk losing the benefits forever – potentially costing parties many thousands of pounds in tax relief and negatively impacting the future value of the property.

RISKS OF iNACCURATE REPORTING

Section 32 of the CPSE relates to Plant and Machinery embedded within the property and must be accurately completed so that tax relief is not lost to either buyer or seller.

If Section 32 of the CPSE has any of the following it is likely not accurate and requires a review from HMA Tax:

- The field is left ‘blank’ or ‘nil’

- A £0, £1 or £2 value

- States ‘Referred to Accountant’ or similar

A failure to deal with Capital Allowances correctly could result in a complete loss of Allowances for current and future taxpayers who own the property.

This is likely to have a negative impact upon the market value of the property in the future.

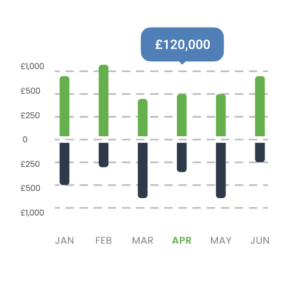

PORTFOLIO REVIEW

A portfolio or client review can help identify potential clients and properties that are eligible for a Capital Allowances claim.

Your client base is likely holding thousands of pounds of tax relief in the form of unclaimed Capital Allowances. If you have a client who owns commercial property, we can identify, value and claim the Capital Allowances, providing either a tax rebate or ongoing tax relief.

- We can assist you in making a request for the transference of rights on Capital Allowances.

- Where viable, your client will receive the maximum tax benefit available.

- You’re protected from litigation due to inaccurate CPSE 32 entries.

- We work with hundreds of legal firms across the UK to help their client’s claim these allowances.

DISCOVER UNCLAIMED TAX RELIEF TODAY

Embedded Capital Allowance claims can be completed within just 4-weeks from initial engagement.

At HMA Tax, we are proudly the UK’s leading Capital Allowance specialists and will ensure that you or your clients claim is quickly processed, efficiently on our part and effortlessly on yours.

- Desktop Review

- Due Diligence Check

- Property Survey

- Capital Allowance Report

- Review

- Submit to HMRC

- Refund & Ongoing Tax Relief

The UK's Leading Capital Allowance Partner

Each month, we identify over £14m in Capital Allowances for commercial property owners

PROACTIVE COMMERCIAL PROPERTY TAX SPECIALISTS

TRUSTED BY LEGAL PRACTICES ACROSS THE GLOBE

By partnering with us, your team can tap into our specialised knowledge and experience, ensuring that your clients receive the maximum tax relief available on their commercial property. Additionally, partnering with HMA Tax can save accountants time and resources, as we will handle the complex and time-consuming process of identifying and claiming capital allowances on behalf of their clients. Overall, partnering with HMA Tax allows accountants to provide a more comprehensive service to their clients and increases the value of their relationship with them.

Although you may be able to identify some expenditure that can be claimed on behalf of your clients, many items may be mislabeled or hidden, and this is where our team of experts can help. Our specialist team includes a chartered surveyor, chartered tax advisor, and quantity surveyor, who can work with you to identify Embedded Capital Allowances and help your clients achieve significant tax relief.

By partnering with HMA Tax, you can offer your clients a valuable service that they may not have known was available to them. Our team of experts can help you unlock tax relief for your clients, providing peace of mind and additional financial stability.

How much information do I need to provide?

We only need basic contact details for your client and details of the property they are buying or selling. These include last purchase price, ownership details and purchase date.

What if my client is not eligible to claimed Capital Allowances?

If there is no claim potential then we will provide you with written confirmation of this and the appropriate information for the s198/199 entries.

Will you provide the s198/199 entries?

Yes! These will be sent directly to you once we have confirmed your client’s position.

How can we be sure your firm will indemnify our practice?

We have completed thousands of claims with a 100% approval rate with HMRC. We also have a team of qualified Accountants, Tax Advisors and Surveyors. And of course we have appropriate PI cover.

Can this exercise cause a problem with HMRC?

Capital Allowances are part of standard business routines and are therefore claimed each year against cost clients incur to operate. HMRC does not take issue with Capital Allowance claims on the basis we adhere to guidelines and the legislation applicable to each claim.

Fortunately, at HMA Tax we have a flawless, 100% success rate with claims we have made to HMRC and have never had an issue completing a claim with HMRC.

JOIN SOME OF THE UK’S LARGEST LEGAL PRACTICES

SPEAK WITH A CAPITAL ALLOWANCE SPECIALIST

Recent news for commercial property Solicitors

Read our recent industry news and insights, written by our own

Capital Allowance specialists.