BECOME A PROFESSIONAL PARTNER

Accountants play a critical role in managing their clients' financial affairs, but they are not always experts in tax relief on capital expenditures. Many accountants may not have the necessary expertise or resources to identify all the potential Embedded Capital Allowances that could be claimed on behalf of their clients.

ARE YOUR CLIENTS MISSING OUT?

Less than 20% of UK property owners have claimed the Capital Allowances that they are entitled to. For some firms, this is a significant litigation risk due to consequential losses on unclaimed allowances.

Our dedicated team of Claims Specialists work directly with you and your clients to ensure that they are utilising and maximising the tax relief that they are entitled to within the scope of the Capital Allowance Act 2001.

PORTFOLIO REVIEW

As a firm, a review of your existing clients can quickly provide immense value to clients who own, operate or invest in commercial property. Our team can complete a portfolio wide review from a few key details about the property and ownership structure.

Our ability to determine if a property is eligible for a Capital Allowance claim does not require disclosing any confidential information on your or your clients part, making it a stress free exercise.

Simply through a desktop review of your clients property, we can determine if they are eligible for significant tax relief that is often overlooked by the vast majority of UK accountants.

- The UK’s leading Capital Allowance specialists at your service

- Seamless integration with your practice

- Expert Claim Identification

- Maximised tax relief for your clients

- A trusted partner to thousands of Accountants across the globe

DISCOVER UNCLAIMED TAX RELIEF TODAY

Embedded Capital Allowance claims can be completed within just 4-weeks from initial engagement.

At HMA Tax, we are proudly the UK’s leading Capital Allowance specialists and will ensure that you or your clients claim is quickly processed, efficiently on our part and effortlessly on yours.

- Desktop Review

- Due Diligence Check

- Property Survey

- Capital Allowance Report

- Review

- Submit to HMRC

- Refund & Ongoing Tax Relief

The UK's Leading Capital Allowance Partner

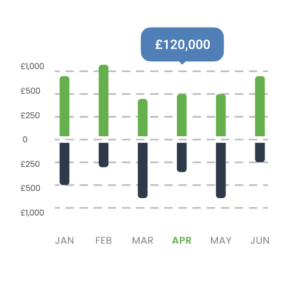

Each month, we identify over £14m in Capital Allowances for commercial property owners

PROACTIVE COMMERCIAL PROPERTY TAX SPECIALISTS

TRUSTED BY THOUSANDS OF UK & INTERNATIONAL ACCOUNTANCY PRACTICES

By partnering with us, your team can tap into our specialised knowledge and experience, ensuring that your clients receive the maximum tax relief available on their commercial property. Additionally, partnering with HMA Tax can save accountants time and resources, as we will handle the complex and time-consuming process of identifying and claiming capital allowances on behalf of their clients. Overall, partnering with HMA Tax allows accountants to provide a more comprehensive service to their clients and increases the value of their relationship with them.

Although you may be able to identify some expenditure that can be claimed on behalf of your clients, many items may be mislabeled or hidden, and this is where our team of experts can help. Our specialist team includes Surveyors, Chartered Accountants and Tax Specialists to ensure we can help your clients achieve significant tax relief.

By partnering with HMA Tax, you can offer your clients a valuable service that they may not have known was available to them. Our team of experts can help you unlock tax relief for your clients, providing peace of mind and additional financial stability.

I’ve thought claiming Capital Allowances impacted upon Capital Gains when a client sells their asset?

The most common misconception is that any savings achieved by claiming Capital Allowances will be cancelled out later by a increased capital gains tax (in the event that the asset is sold).

This is not true. Section 41 TCGA 1992 specifically details that it is not necessary to deduct any Capital Allowances from the cost of an asset for capital gains purposes. So, it is not possible for a Capital Allowance claims to create or increase a chargeable gain.

Why would I have not already maximised the available Capital Allowances for my client?

There’s no doubt accountants have methods for assessing Capital Allowances and therefore it’s important to stress that we’re not questioning their or your ability. However, ultimately accountants rarely operate at the granular detail that Embedded Capital Allowances specialists such as HMA Tax do.

Our approach involves being highly skilled and efficient within this specialist sector of commercial property tax law. Compliant, accurate and maximised Embedded Capital Allowances claims are only possible by introducing additional disciplines that add value to their or your work; these include the inputs of expert property Surveyors and specialist Tax Accountants, as well as the proper procedures for claiming the identified relief and rebates from HMRC.

Will this cause a problem with HMRC?

Capital Allowances are part of standard business routines and are therefore claimed each year against cost clients incur to operate. HMRC does not take issue with Capital Allowance claims on the basis we adhere to guidelines and the legislation applicable to each claim.

Fortunately, at HMA Tax we have a flawless, 100% success rate with claims we have made to HMRC and have never had an issue completing a claim with HMRC.

JOIN SOME OF THE UK’S LARGEST ACCOUNTING FIRMS

SPEAK WITH A CAPITAL ALLOWANCE SPECIALIST

Recent news for Accountants

Read our recent industry news and insights, written by our own

Capital Allowance specialists.